Download Available Documents

The Background

As the backbone of the Swiss financial industry, SIX must understand the potential effects and relevance of the many developments we are currently witnessing — from new technologies, to political shifts, social changes, and business model innovations. To answer questions about the future of cash we have to take into account how money more generally might evolve. What is considered money, what form it takes, and how it is used, all look set to change dramatically in the near future. The goal of the new white paper Money is to help decision-makers set the strategic direction.

Our Approach and Key Findings

Questions Tackled

Experts Involved

Future Scenarios Developed

Key Findings

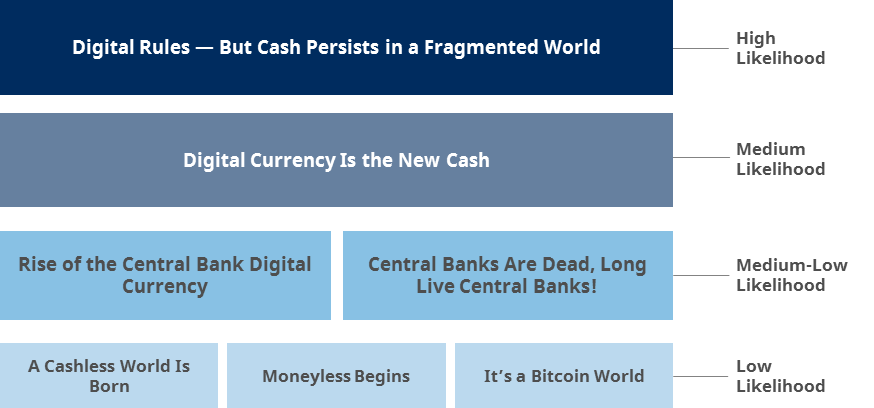

We have identified seven future scenarios that we think will be of interest to strategic decision-makers in the money infrastructure and service space. Besides a most likely scenario, we have identified several alternative scenarios that we believe could have a substantial impact on the money infrastructure and/or may necessitate considerable adaptations in decision-makers’ mental frameworks.

1. Digital Rules — But Cash Persists in a Fragmented World

Digital payments have substantially increased in convenience compared to cash as digital user interfaces expand into ever more human activities. At the same time, cash continues to be perceived and widely used as a ‘store of value’.

2. Digital Currency Is the New Cash

Cash holdings drop 80%. Digital means have not only replaced cash as the dominant ‘means of payment’, digital money/assets have also largely displaced cash as a safe ‘store of value’.

3. Rise of the Central Bank Digital Currency

Anyone can hold digital currency issued by the central bank. People can choose where to hold their digital currency, at an account with the central bank and/or a commercial bank.

4. Central Banks Are Dead, Long Live Central Banks!

New centrally-issued currencies are the new money. New currencies and issuers replace sovereign currencies respectively states’ central banks (e.g., CHF and SNB, EURO and ECB).

5. A Cashless World Is Born

Cash disappears completely. The cashless society is finally born. A ‘digital cash’ infrastructure may take the place of the ‘physical cash’ infrastructure, which guarantees the same levels of security and anonymity/privacy as physical cash.

6. Moneyless Begins

There is no such thing as ‘money’ anymore. No asset in the economy — not even currencies — fulfills the conditions for it to be classified as ‘money’.

7. It’s a Bitcoin World

Decentralized digital currencies have become dominant: Crypto-currencies (e.g., Bitcoin, Ether) have replaced central-bank-issued currencies as the dominant forms of money.

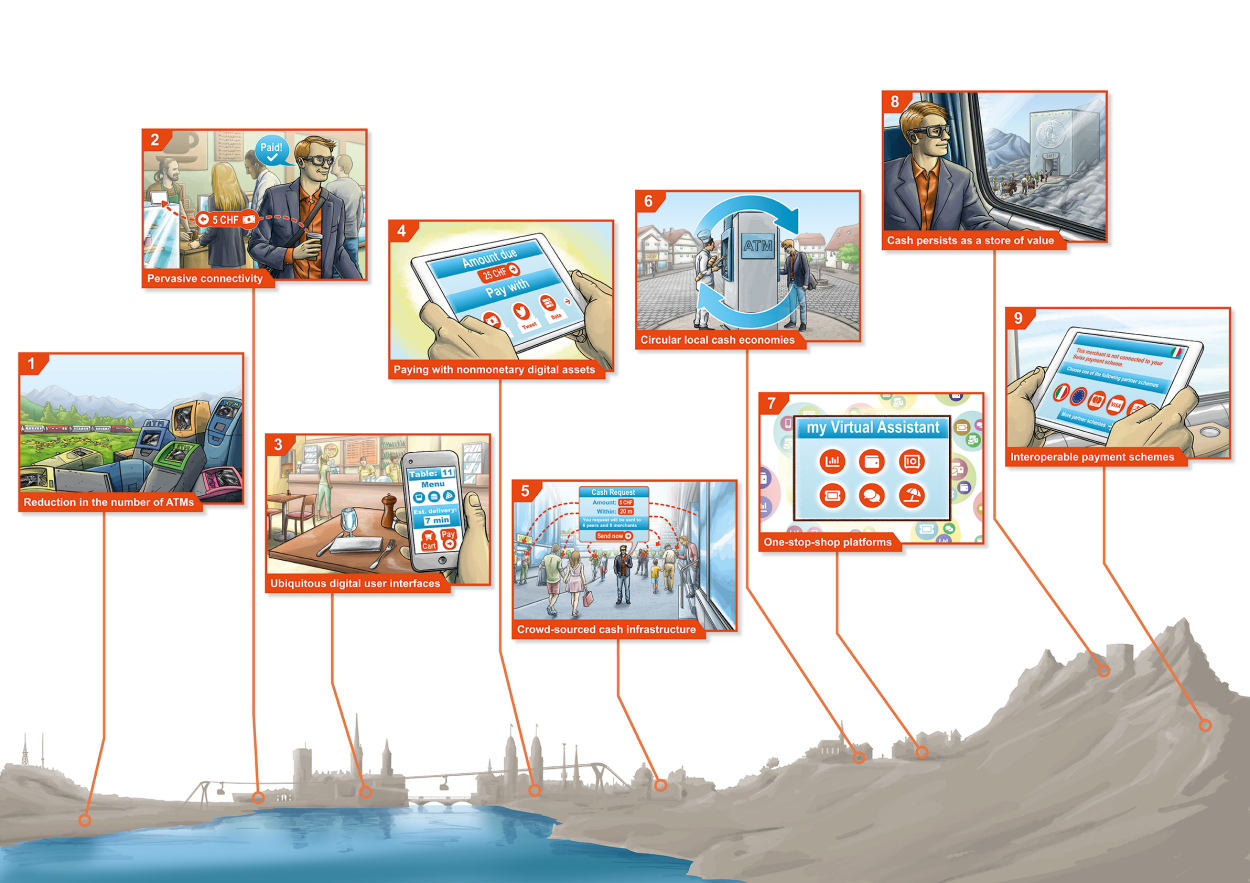

What Could the Most Likely Scenario “Digital Rules” Mean for Our Daily Lives?

Meet Felix Muster in the year 2025.

At first glance, the life of Felix has hardly changed over the last few years: At half past six in the morning his smartphone wakes him. A few minutes later, Felix contemplates in the bathroom mirror the latest news alongside the most important data on his income and expenditures, while the toothbrush dutifully analyzes his health. The data is then shared with the medication robot in the kitchen, which dispenses the vitamins and additional tablets for the day.

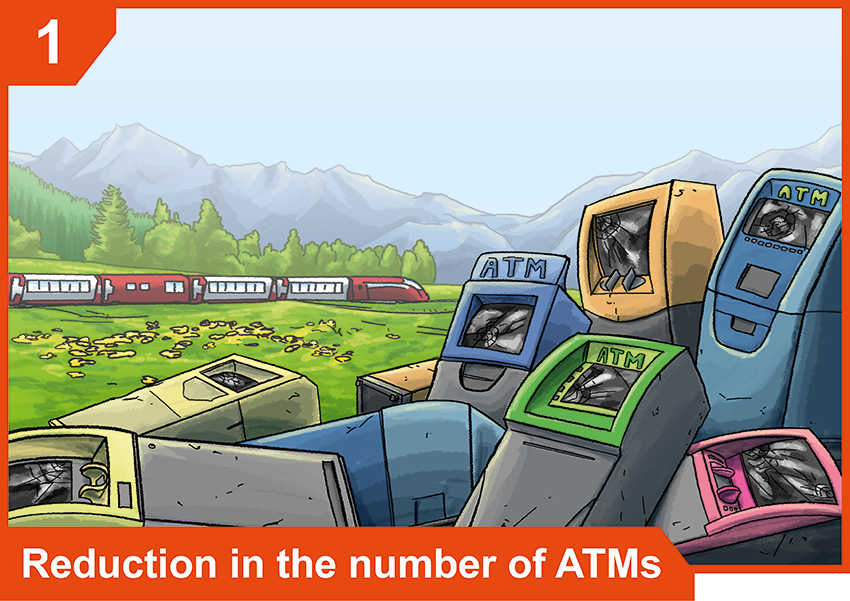

At 7:33 am, his commuter train leaves from his suburban community on Lake Zurich to Zurich main station. From his train window, he sees an ATM cemetery, where some of the many out-of-service ATMs are temporarily stored before being dismantled (reduction in the number of ATMs).

At the main station, his favorite coffee is already waiting in the coffee shop next door — he preordered it while still on the train via his digital assistant, which perfectly timed the order to ensure it was just the right temperature. While walking out of the coffee shop, Felix gets the notification from his digital assistant that his bank account has been charged with a take-away espresso (pervasive connectivity).

Only when the weather is fine and he does not meet any colleagues in the tram does Felix use the E-scooters, which have become surprisingly robust in recent years, for the last 700 hundred meters.

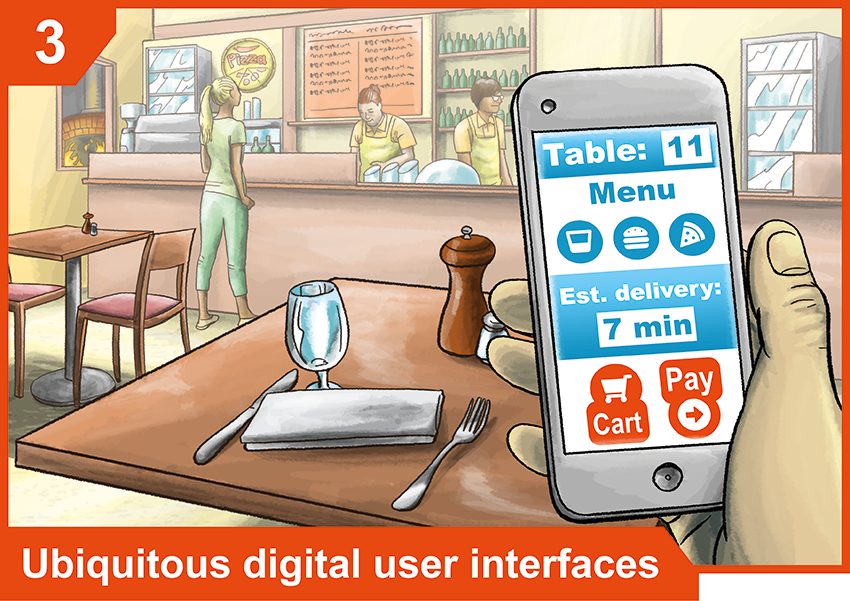

Later in the morning, Felix meets his best friend for lunch in a pizzeria. At the front door, Felix asks his digital assistant for their table, which they find easily thanks to the exact guidance of his digital assistant. They both consult the menu on Felix’s smartphone. Both decide on a pizza, which they order via Felix’s digital assistant (ubiquitous digital UIs).

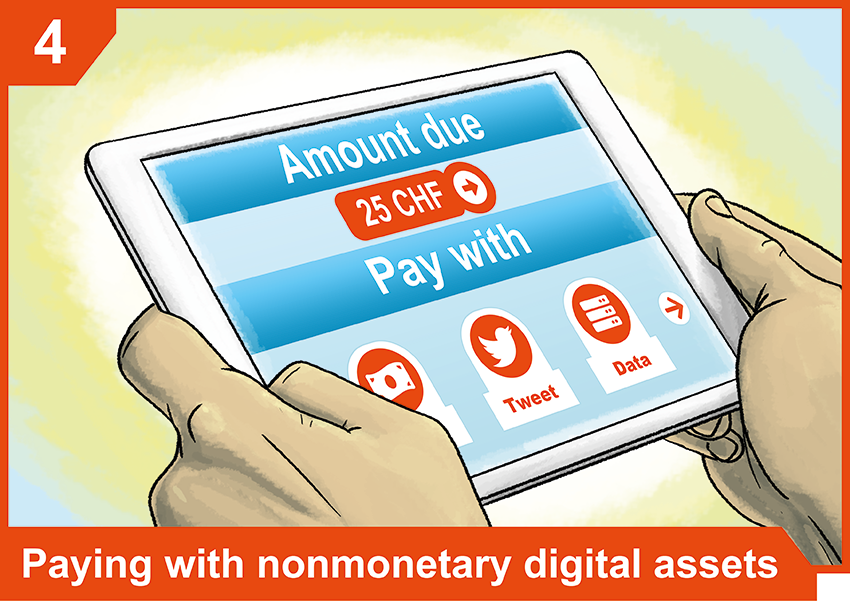

After yet another coffee, Felix offers to pay for both and asks his assistant to pay the bill. He is informed that he can pay part of it with the data they both produced in the restaurant, and that he can get an additional discount if he Tweets about the restaurant. Felix tells his digital assistant to do both and mention that the pizza was fantastic (nonmonetary assets as means of payment).

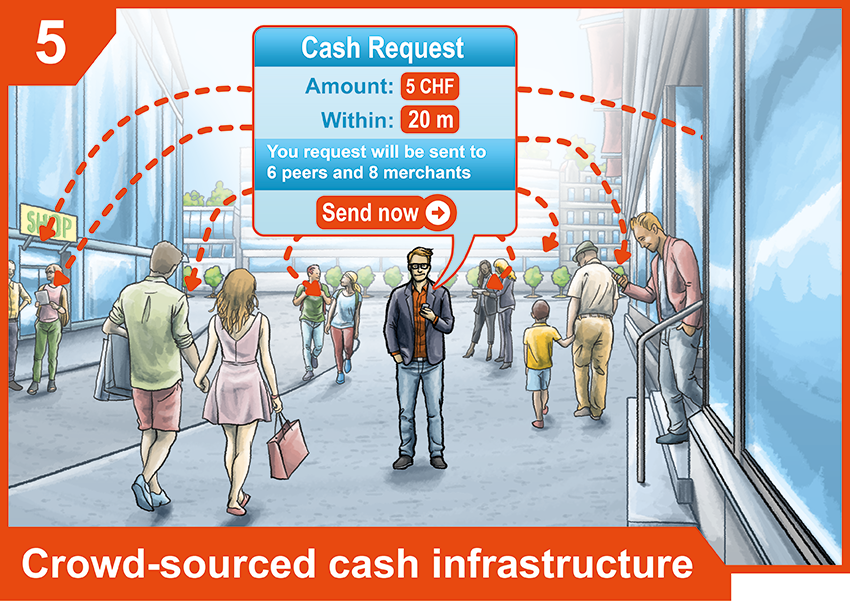

Before leaving, he wants to tip the pizzaiolo in cash. Old habits die hard. Felix looks into his wallet and notices that he has no cash. He asks his digital assistant to query people and merchants nearby for 5CHF in cash (crowdsourced cash infrastructure). A young lady walks up to him, holding CHF 5 in one hand, and her smartphone with a QR code in the other. Felix scans the code and asks his digital assistant to transfer 5 CHF of digital money to that account. Before he can finish his sentence, the young lady receives a message that the amount has been transferred to her account — digital payments have really become instantaneous.

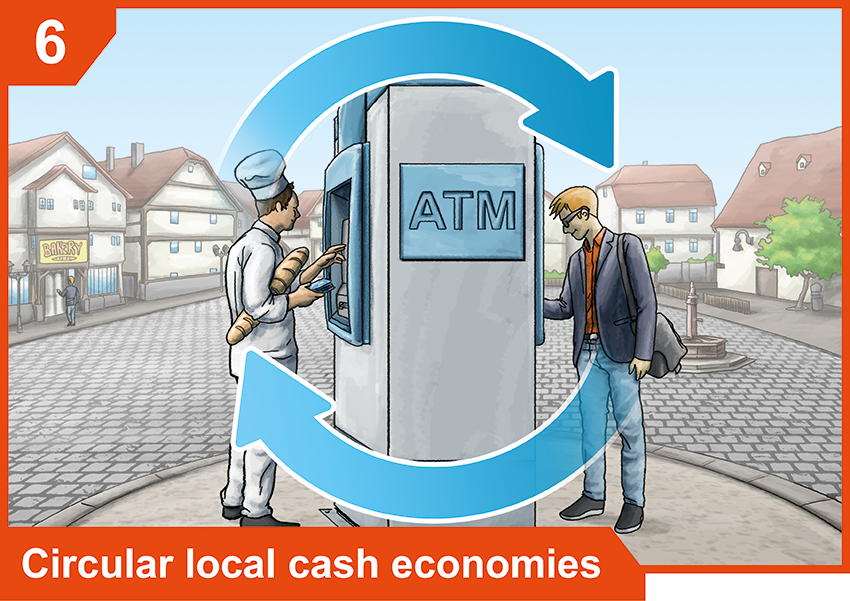

Later that day, Felix is back in his village and hurries to get some bread. He arrives, sweaty, but just in time as the baker was about to close the door. Happy and hungry, Felix walks away with the bread under his arm, and observes the baker walking away with a wallet full of cash toward the village ATM — there used to be many more. Felix remembers an article talking about merchants recharging local ATMs, thus producing an almost self-sufficient local cash economy: Locals take out cash at the local ATM, spend it at local merchants, who then recharge the local ATM (circular local cash economies). It is true, he cannot remember when he last saw an armored truck bringing cash to the local ATM.

At home, it’s 6:44 pm, and Felix still finds the time to discuss the summer holiday plans with his partner Sonja and their two children. His digital assistant connects to a onestop-shop digital platform, integrating all relevant unbundled services by different financial services providers, and synthesizes all relevant information about account balances and savings (one-stop-shop platforms).

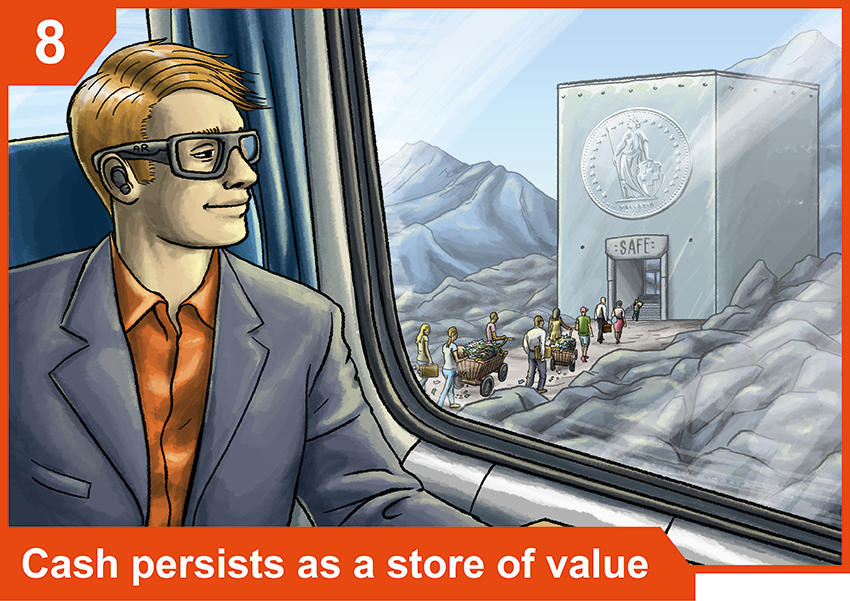

The group decides it will once again enjoy two weeks in the mountains in northern Italy. The next morning, they all hop into the green-electricity-powered train heading to Italy. His daughter points her finger and asks what those weird bunker-like buildings are. Felix does not know either. Lucky them, his digital assistant does: They are physical vaults built under the Alps for people to safekeep their valuables, including cash. Cash is still viewed as a safe store of value; the digital assistant adds (cash persists as a store of value).

Before even having both feet on the ground in Northern Italy, his older daughter already runs towards a gelato stand. Felix joins her at the stand and knows he will have no problem paying with his Swiss mobile wallet.

His digital assistant, however, informs him that the gelato vendor is not connected to his default Swiss payment scheme. The digital assistant then asks him to choose between partner payment schemes that are connected to the merchant and interoperable with his Swiss payment scheme (interoperable payment schemes).

Only Felix’s favorite ice cream flavors have survived through the years: vanilla, strawberry and chocolate.

Not everything has changed in Felix’ life…